To provide attractive risk adjusted returns versus the Russell 1000 Value over a full market cycle.

Large Cap – Concentrated 30

Description

Objective

Investment Merits

1. Long-term capital appreciation and total return

Performance has exceeded peers and benchmark since inception

2. Opportunity derived from market emotion

Timeless investment philosophy with a disciplined process designed to eliminate behavioral biases

3. Focus on companies with proven track records trading at a discount to fair value

Cornerstone’s proprietary Fair Value Model has successfully identified attractively valued companies for over 30 years

4. Concentrated portfolio with high active share

Portfolio encompasses 30 of our most compelling ideas

Video Introduction

Concentrated 30 Strategy

Process

Conduct Investment Meetings Daily

- Confirm relevance of historical track record

- Eliminate fundamentally flawed companies

- Build investment case, run sensitivity analysis, stress test assumptions

- Identify what the market is mispricing

Determine whether past fundamentals are repeatable

Investment Team Members assess the merits of companies independently before collaborating for final review

1. Verify valuation and Dissect Financials

Assess company financials and valuation case

2. Evaluate Business Model

Identify embedded characteristics and keys to success

3. Appraise Management

Measure success of management over time

4. Assess Competitive Threats

Monitor competitors, substitutes and new entrants

5. Understand Operating Environment

Legislation, litigation, regulations, and exogenus inputs

Most compelling 30 stocks chosen

Meet weekly, at minimum, to discuss present weights and the manufacturing facility

Positions typically start at 2%

Size of the position based on:

- Discount to our Fair Value

- Relative Attractiveness

- Risk Considerations

*Historical Turnover of ~30%

*12/31/14 – 12/31/24

Portfolio turnover is calculated by taking the lesser of purchases or sales then dividing it by the average market value of the portfolio. Fair Value is a term relating to the Cornerstone Investment Partners’ Fair Value Methodology.

Risk Management

Ongoing evaluation of risk is critical when managing a concentrated portfolio

- Weekly meetings to discuss position and sector weights, exposures, and macroeconomic risks

- Ad hoc reviews conducted in response to outsized stock price movement or new information

- Risk controlled at the security level

- Maximum position size of 6%

- Sector weights range from 0-30%

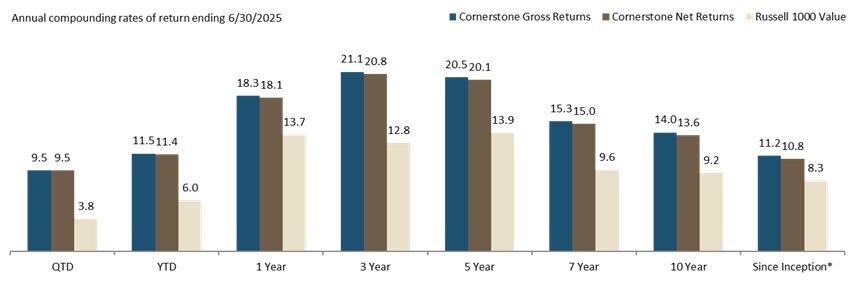

| Cornerstone Gross Returns |

Cornerstone Net Returns |

Russell 1000 Value |

|

|---|---|---|---|

| QTD | 9.54% | 9.48% | 3.79% |

| 1 Year | 18.32% | 18.06% | 13.70% |

| 3 Year | 21.12% | 20.83% | 12.76% |

| 5 Year | 20.47% | 20.15% | 13.93% |

| 7 Year | 15.31% | 14.97% | 9.59% |

| 10 Year | 13.97% | 13.62% | 9.19% |

| Since Inception* | 11.25% | 10.83% | 8.31% |

Annual compounding rates of return ending 6/30/2025

*Composite inception date is 9/30/2001

| Cornerstone Gross Returns |

Cornerstone Net Returns |

Russell 1000 Value |

Gross Composite 3yr St Dev |

R1000V 3yr St Dev |

Composite assets $millions | Accounts at period end | Percent of firm assets | Firm assets $millions | Gross Composite dispersion |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 22.64% | 22.36% | 14.37% | 16% | 17% | 1,382.8 | 19 | 64.7% | 2,135.8 | 0.2 |

| 2023 | 22.90% | 22.60% | 11.46% | 16% | 17% | 1,222.8 | 21 | 65.4% | 1,896.9 | 0.1 |

| 2022 | -10.50% | -10.73% | -7.54% | 22% | 21% | 1,121.7 | 20 | 65.8% | 1,703.9 | 0.1 |

| 2021 | 29.99% | 29.56% | 25.16% | 20% | 19% | 1,265.1 | 21 | 65.5% | 1,932.1 | 0.1 |

| 2020 | 11.93% | 11.52% | 2.80% | 20% | 20% | 1,042.8 | 22 | 56.9% | 1,831.3 | 0.5 |

| 2019 | 30.73% | 30.30% | 26.54% | 12% | 12% | 1,519.0 | 28 | 66.0% | 2,300.8 | 0.2 |

| 2018 | -6.08% | -6.41% | -8.27% | 12% | 11% | 1,631.3 | 32 | 75.2% | 2,169.9 | 0.3 |

| 2017 | 26.80% | 26.36% | 13.66% | 12% | 10% | 1,910.0 | 40 | 77.7% | 2,458.6 | 0.1 |

| 2016 | 16.82% | 16.44% | 17.34% | 13% | 11% | 2,154.2 | 42 | 82.5% | 2,609.7 | 0.4 |

| 2015 | -13.54% | -13.87% | -3.83% | 12% | 11% | 2,741.3 | 60 | 78.8% | 3,480.2 | 0.3 |

| 2014 | 8.41% | 8.08% | 13.45% | 10% | 9% | 7,857.3 | 101 | 85.8% | 9,154.3 | 0.2 |

| 2013 | 35.18% | 34.74% | 32.53% | 12% | 13% | 6,664.9 | 91 | 81.2% | 8,210.6 | 0.5 |

| 2012 | 15.32% | 14.97% | 17.51% | 15% | 16% | 3,996.3 | 78 | 69.8% | 5,725.4 | 0.2 |

| 2011 | 3.89% | 3.50% | 0.39% | 19% | 21% | 1,969.3 | 65 | 56.8% | 3,466.7 | 0.2 |

| 2010 | 13.08% | 12.61% | 15.51% | 21% | 23% | 989.1 | 62 | 41.3% | 2,394.8 | 0.4 |

| 2009 | 24.90% | 24.37% | 19.69% | 20% | 21% | 485.1 | 52 | 33.7% | 1,437.6 | 0.8 |

| 2008 | -28.08% | -28.45% | -36.84% | 14% | 15% | 105.0 | 25 | 17.1% | 613.0 | 0.4 |

| 2007 | 12.53% | 11.99% | -0.17% | 8% | 8% | 71.7 | 14 | 12.6% | 569.1 | 0.2 |

| 2006 | 17.71% | 17.24% | 22.25% | 7% | 7% | 206.8 | 39 | 54.1% | 382.5 | 1.0 |

| 2005 | 8.65% | 8.24% | 7.05% | 10% | 9% | 111.8 | 22 | 45.3% | 246.9 | 0.5 |

| 2004 | 12.99% | 12.30% | 16.49% | 18% | 15% | 45.6 | 15 | 36.9% | 123.6 | 0.5 |

| 2003 | 31.62% | 30.98% | 30.03% | N.R. | N.R. | 5.8 | 5 or fewer | 11.4% | 50.7 | N.A.* |

| 2002 | -16.80% | -17.33% | -15.52% | N.R. | N.R. | 2.4 | 5 or fewer | 10.6% | 22.1 | N.A.* |

| 2001* | 14.97% | 14.97% | 7.37% | N.R. | N.R. | 2.0 | 5 or fewer | 13.0% | 15.4 | N.A.* |

*Composite inception date is 9/30/2001

N.R. – Not Required

Characteristics

June 30, 2025

The end result of the investment process is a portfolio comprised of companies with solid growth prospects trading at compelling valuation levels.

| Characteristics | C30 | Russell 1000 Value |

|---|---|---|

| 5 Yr Hst. EPS Growth(Ex-Zeros) | 15.9% | 12.6% |

| LT Est. EPS Growth—Wtd Avg | 12.0% | 9.5% |

| Price/Earnings (TTM)—Wtd HAvg | 19.6x | 18.3x |

| Price/Cash Flow—Wtd Avg | 16.0x | 12.2x |

| LT Debt to Equity—Wtd HAvg | 0.4x | 0.1x |

| Dividend Yield—Wtd Avg | 0.9% | 1.9% |

| Market Cap—Wtd Avg | 561.4B | 292.1B |

Disclaimer

Concentrated 30 Institutional Composite contains fully discretionary institutional accounts that are typically comprised of 27-35 securities that may or may not pay dividends and are suitable for those clients with an emphasis on long-term capital appreciation and have an above-average risk tolerance. For comparison purposes the composite is measured against the Russell 1000 Value Index. Cornerstone Investment Partners’ has constructed a universe of 800 large, liquid securities, including non-US companies, traded on US exchanges. Cornerstone Investment Partners, LLC is an independent, employee owned investment advisory firm. The firm maintains a complete list and description of composites, which is available upon request. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Past performance is not indicative of future results. N.A.- Information is not statistically meaningful due to an insufficient number of portfolios in the composite for the entire year. The U.S. Dollar is the currency used to express performance. Returns are presented gross and net of management fees and include the reinvestment of all income. Gross returns were reduced by transaction costs. Net of fee performance was calculated using actual management fees, a model fee based on the standard investment advisory schedule was applied to non-fee paying accounts. Beginning October 1, 2008, composite policy requires the temporary removal of any portfolio incurring a client initiated significant cash inflow or outflow of 30% of portfolio assets. The Concentrated 30 Composite was created on April 1, 2010. The annual composite dispersion is an asset-weighted standard deviation calculated for the accounts in the composite the entire year. Cornerstone Investment Partners claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Cornerstone Investment Partners has been independently verified for the periods September 30, 2001 thru December 31, 2024. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Concentrated 30 composite has had a performance examination for the periods September 30, 2001 thru December 31, 2024. The verification and performance examination reports are available upon request. Benchmark returns are not covered by the report of independent verifiers. As of January 1, 2007, the composite was split into a tax sensitive composite and a non-tax sensitive composite to better reflect our performance for each account type. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. Submit requests to Cornerstone Investment Partners: 3438 Peachtree Rd, Suite 900. Atlanta, GA 30326; Phone: 404-751-3850; Email: marketing@cornerstone-ip.com. The general fee schedule for equity accounts is as follows: 0.55% on the first $20,000,000; 0.45% on the next $20,000,000 and 0.35% on the balance. Actual investment advisory fees incurred by clients may vary. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Due to the marketing rule that went into effect on 11/4/22, the net returns were updated to comply with this regulation. Additional information is available upon request.