A diversified portfolio of small cap stocks, focused on identifying high-quality companies that are demonstrating improving fundamentals. The strategy’s goal is to provide attractive risk-adjusted returns versus the Russell 2000 over a full market cycle.

Small Cap/SMID – Diversified Small Cap Core

Description

Objective

Investment Merits

1. Exposure to the attractive returns of the small cap asset class while minimizing the risk

Small cap stocks have a history of outperformance, but come with higher risk. DSCC aims to mitigate that risk through diversification and our stock selection process.

2. Rules-based fundamental approach adds discipline and avoids behavioral biases

Many small cap stocks trade on stories in the short run, but in the long run fundamentals win out. The DSCC strategy is rules-based to focus on what matters in small caps.

3. Focus on companies that are demonstrating improving fundamentals and financial flexibility

Small cap stocks can grow quickly, but face greater cyclical risks. DSCC is designed to identify companies with strong fundamental performance and robust defensive characteristics.

4. Core approach has performed well in a range of market environments

DSCC has historically performed well in both growth and value environments, and has provided downside protection during weaker periods for small cap stocks.

Video Introduction

Diversified Small Cap Core Strategy

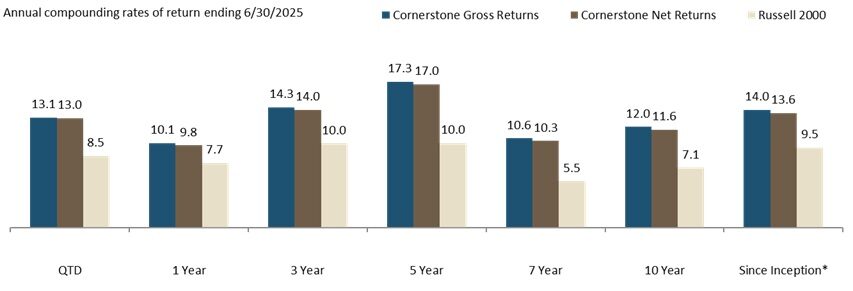

Performance

Value

| Cornerstone Gross Returns |

Cornerstone Net Returns |

Russell 2000 | |

|---|---|---|---|

| QTD | 13.08% | 13.02% | 8.50% |

| 1 Year | 10.06% | 9.78% | 7.68% |

| 3 Year | 14.28% | 14.00% | 10.00% |

| 5 Year | 17.34% | 17.04% | 10.04% |

| 7 Year | 10.61% | 10.30% | 5.52% |

| 10 Year | 11.97% | 11.63% | 7.12% |

| Since Inception* | 13.97% | 13.61% | 9.50% |

Annual compounding rates of return ending 6/30/2025

*Composite inception date is 6/30/2012

| Cornerstone Gross Returns |

Cornerstone Net Returns |

Russell 2000 | Gross Composite 3yr St Dev |

Russell 2000 3yr St Dev |

Composite assets $millions | Accounts at period end | Percent of firm assets | Firm assets $millions | Gross Composite dispersion | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 14.42% | 14.14% | 11.54% | 23% | 23% | 48.23 | 5 or fewer | 2.258% | 2,135.8 | N.A.* |

| 2023 | 22.96% | 22.65% | 16.93% | 22% | 21% | 44.14 | 5 or fewer | 2.328% | 1,896.9 | N.A.* |

| 2022 | -18.41% | -18.62% | -20.44% | 26% | 26% | 44.32 | 5 or fewer | 2.601% | 1,703.9 | N.A.* |

| 2021 | 44.80% | 44.44% | 14.82% | 23% | 23% | 56.67 | 5 or fewer | 2.933% | 1,932.1 | N.A.* |

| 2020 | 22.37% | 22.05% | 19.96% | 25% | 25% | 48.53 | 5 or fewer | 2.650% | 1,831.3 | N.A.* |

| 2019 | 18.75% | 18.33% | 25.52% | 16% | 16% | 5.15 | 5 or fewer | 0.224% | 2,300.8 | N.A.* |

| 2018 | -5.78% | -6.12% | -11.01% | 16% | 16% | 4.40 | 5 or fewer | 0.203% | 2,169.9 | N.A.* |

| 2017 | 17.63% | 17.21% | 14.65% | 13% | 14% | 4.67 | 5 or fewer | 0.190% | 2,458.6 | N.A.* |

| 2016 | 23.38% | 22.94% | 21.31% | 15% | 16% | 2.56 | 5 or fewer | 0.098% | 2,609.7 | N.A.* |

| 2015 | -1.17% | -1.52% | -4.41% | 13% | 14% | 0.28 | 5 or fewer | 0.008% | 3,480.2 | N.A.* |

| 2014 | 4.25% | 3.87% | 4.89% | N.R. | N.R. | 0.28 | 5 or fewer | 0.003% | 9,154.3 | N.A.* |

| 2013 | 48.81% | 48.31% | 38.82% | N.R. | N.R. | 0.46 | 5 or fewer | 0.006% | 8,210.6 | N.A.* |

| 2012* | 8.39% | 8.21% | 7.20% | N.R. | N.R. | 0.31 | 5 or fewer | 0.005% | 5,725.4 | N.A.* |

*Composite inception date is 6/30/2012

N.R. – Not Required

Characteristics

June 30, 2025

The end result of the investment process is a portfolio comprised of companies with solid growth prospects trading at compelling valuation levels.

| Characteristics | DSCC | Russell 2000 |

|---|---|---|

| 5 Yr Hst. EPS Growth(Ex-Zeros) | 21.1% | 16.5% |

| LT Est. EPS Growth—Wtd Avg | 22.0% | 12.5% |

| Price/Earnings (NTM)—Wtd HAvg | 16.9x | 14.8x |

| Price/Cash Flow—Wtd Avg | 9.2x | 8.9x |

| Net Debt to EBITDA (LTM)—Wtd Avg | 0.7x | 1.7x |

| Dividend Yield—Wtd Avg | 1.0% | 1.4% |

| Market Cap—Wtd Avg | 2.3B | 3.4B |

| Market Cap—Median | 1.8B | 0.9B |

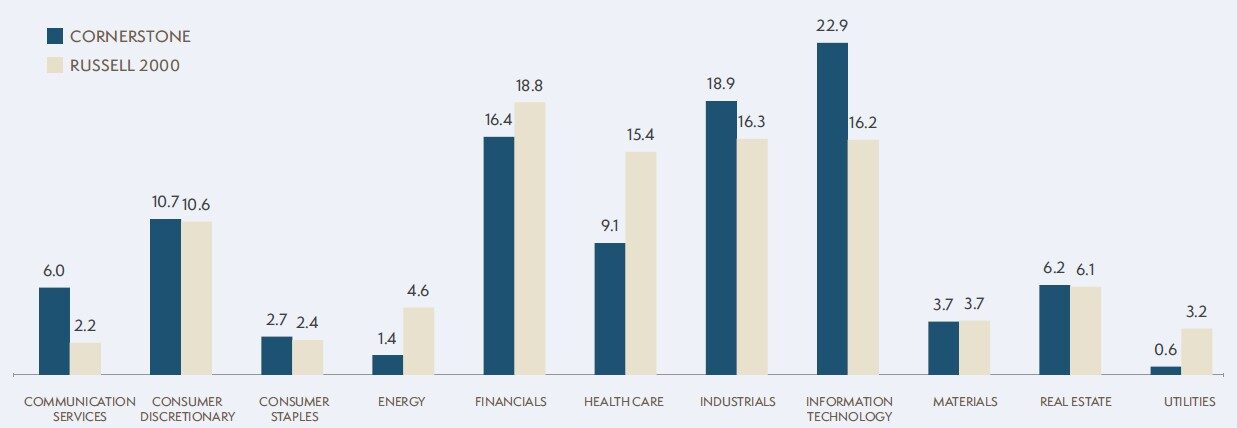

Sector Weights

June 30, 2025

Sector weights can be materially different from the benchmark as a result of our bottom-up investment process

Disclaimer

Diversified Small Cap contains fully discretionary accounts that are comprised of around 230-250 securities that typically have capitalizations between $250M and $3B. For comparison purposes, the composite is measured against the Russell 2000 Index. Cornerstone Investment Partners is an independent, employee-owned investment advisory firm. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Past performance is not indicative of future results. The U.S. Dollar is the currency used to express performance. Returns are presented gross and net of management fees and include the reinvestment of all income. Net of fee performance was calculated using actual management fees. For non-fee-paying accounts, a model fee based on the standard investment advisory schedule was applied. The Diversified Small Cap Core composite was incepted and created on June 30, 2012. N.A.* The annual composite dispersion is an asset-weighted standard deviation calculated for the accounts in the composite for the entire year. This is not shown when there are 5 or fewer accounts in the composite for the entire year as it is not statistically meaningful. Cornerstone Investment Partners claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Cornerstone Investment Partners has been independently verified for the periods September 30, 2001 thru December 31, 2024. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Diversified Small Cap Core composite has had a performance examination for the periods June 30, 2012 thru December 31, 2024. The verification and performance examination reports are available upon request. Benchmark returns are not covered by the report of independent verifiers. Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. To receive a list of composite descriptions and/or additional information, contact Cornerstone Investment Partners at 3438 Peachtree Rd, NE; Suite 900; Atlanta, GA 30326, 404-751-3850 or marketing@cornerstone-ip.com. The general fee schedule for accounts is as follows: 1.00% on the first $10,000,000; 0.75% on the next $40,000,000 and 0.50% on the balance. Actual investment advisory fees incurred by clients may vary. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Due to the marketing rule that went into effect on 11/4/22, the net returns were updated to comply with this regulation. Additional information is available upon request.